Why You Should Consider Emerging Technologies for Accounting & Financial Management Software Reformation?

4 min read | By Admin | 29 November 2019 | Technology

In the present world, business has become complicated with the rapid development of information technology year by year and the adoption of business along with the technology advancement comes with necessity.

Imagine the deterioration of audit work as we are well aware of what will happen in the future.

This is the future prediction about the influence of emerging technology in the accounting field.

With the combination of new emerging technology, a business can utilise data from latest trends, simplify operations and make better decisions on business improvement than competitors. As an economist declares, in a digitised world, data is the oil.

How Far Can Technology Make Its Impact?

Accepting technology is like accepting and maintaining every document in the form of data. Accounting and Financial management application have come so far from having a collection of documents arranged wisely in a spreadsheet to current migration to cloud accounting.

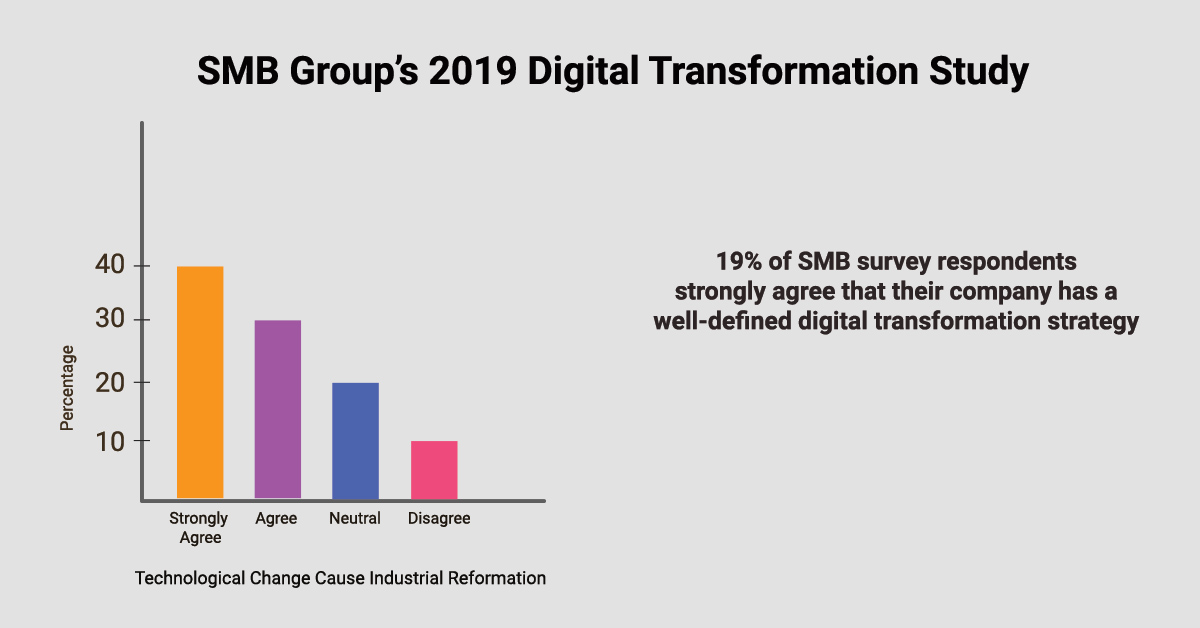

It is estimated that nearly 82% of small and medium sized companies agreed faster access to efficient data helps in achieving their business goals in a short period.

The updated trends in big data, artificial intelligence, mobility, virtual reality and cloud services can have a major impact on every trail of accountants job.

This latest trends have kindled a new level of working pattern for accountants. It has replaced the manual work of every accountant towards the more value added tasks using financial management application.

Technology has reformulated a new path while creating a new normal job in the profession.

Now let us discuss about the latest three upcoming trends that can help build a new phase of work to accounting and financial management application.

Cloud Computing

On discussing about the cloud computing technologies, data security has been the predominant topic to be considered. While the platform is primarily used for storing data, the risk associated with data exposure is high upon data encryption. For this an additional level of security is required for data confidentiality and integrity.

According to Accounting Today,” More firms and their clients are moving from in-house to cloud and this trend does not fade away.”

Choosing the right cloud provider comprises of detailed safety analysis and the cloud computing solution is hosted from remote servers that can be accessed from any external devices.

Imposing more advantage it allows to access financial information from anywhere and users can work on it at any time.By the way, cloud computing is a cheaper option that does not take update or installation costs.

Blockchain

Whenever the discussion topic revolve around Blockchain, Cryptocurrency is the only point that comes in every people’s mind, but the fact of authenticating a currency comes under Blockchain technology.

Blockchain is basically a cryptography method and is used for the exchange of cryptocurrency, property, goods and services through a protected link.

Every single record, links and transactions are stored as blocks and can be viewed only by using a proper encryption key. Although sounds like a budding initiative, Blockchain can reinvent the accounting ledger with its streamlined updates and verification methodologies.

Added to the previous point, Blockchain has been using encryption and decryption keys in order to reduce the hacking trials thereby affording the faster audit process.

IoT

Internet of Things connects everyday things to an internet with sensors. Once incorporated with sensor, these things can save or send real time information to any active IoT powdered devices.

The scenario dictates the replacement of manual effort with automated data collection with precise monitoring and metrics. Since the data are directly generated from one of the IoT devices this reduces the human error.

This is a great impact on Financial sector to view the current data in order to streamline audits and reporting.

Adopting IoT technology in Accounting and Financial application Management can help managers with better insights and control the cost liquidity.

Conclusion

It’s not too late to include these emerging technology trends into your management routine. We are still at the earliest days, however many small and medium sized enterprises understood the prominent importance of these technologies and their advantages in the future.

Just like before the dawn breaks into day, few SMEs hired resources and figure out how to integrate these accounting software and financial management application to grab their opportunities.

Still not yet integrated, contact us today and our developers are ready to mashup the latest trends into your business.

The latest from our editors

Join over 150,000+ subscribers who get our best digital insights, strategies and tips delivered straight to their inbox.

Comments are closed.